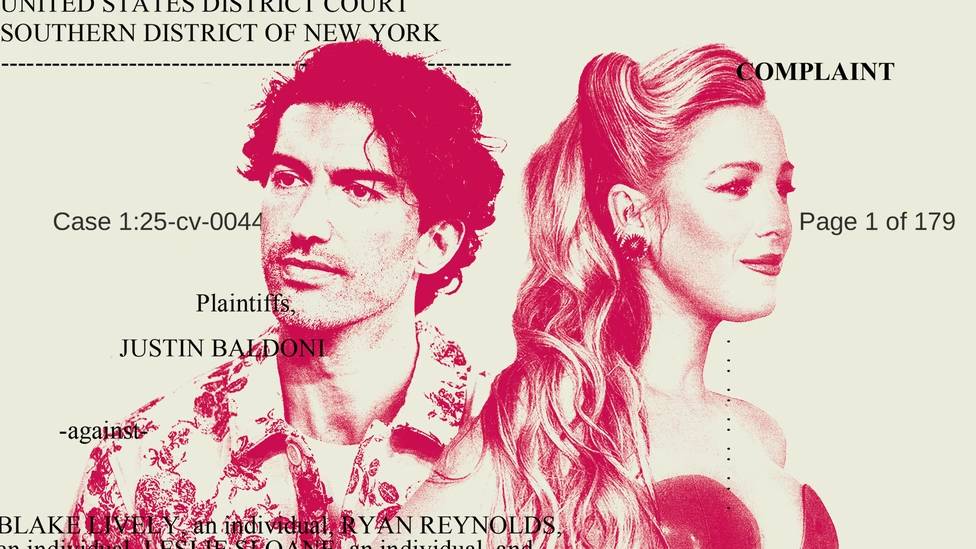

We’re excited—and a little amused—to share that Albertson & Davidson LLP has been featured in a recent piece by Kaitlyn Tiffany for The Atlantic: “Who Reads Entire Lawsuits for Fun?”. Tiffany’s article explores the unexpected online fascination with the ongoing Blake Lively vs. Justin Baldoni lawsuit and how a mix of lawyers, influencers, and content […]